martini.ai Introduces First Free Credit Intelligence Platform for Corporate Lending

martini.ai Introduces First Free Credit Intelligence Platform for Corporate Lending

Opening Access and Transparency to $10 Trillion Corporate Credit Market

PALO ALTO, Calif.--(BUSINESS WIRE)--In a move to tear down barriers in the fast-growing $10 trillion corporate credit market —— martini.ai, a leader in AI-driven credit risk analysis, today unveiled the first free, AI-powered credit intelligence platform for public and private companies.

"Credit risk shouldn’t be locked behind a paywall. We’ve built the fastest, most accurate risk engine available, and now anyone can use it to research companies, industries or portfolios."

Share

Building on the foundation of processing nearly 600 billion predictions daily in their previous work, martini.ai recognized that in today's hyper-connected world — where events like the Suez Canal blockage can instantly ripple through global markets and asset prices — traditional credit risk assessment needed a fundamental reimagining.

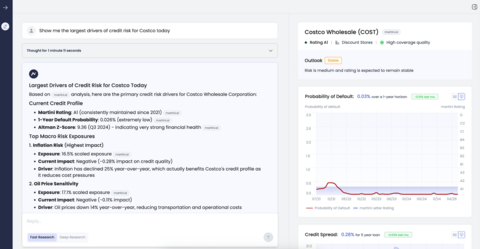

Anyone — from analysts to investors — can instantly access daily-updated credit ratings, in-depth research, and interactive risk tools for over 3.5 million companies, all without an account or paywall. The platform also features an AI-powered research assistant that brings together probability of default curves, sector-wide risk signals, and company-specific insights in a single, intuitive chat interface.

“Credit risk shouldn’t be locked behind a paywall,” said Rajiv Bhat, CEO of martini.ai. “We’ve built the fastest, most accurate risk engine available, and now anyone can use it to research companies, industries or portfolios — empowering transparency and fairness in a $10 trillion market.”

Rebuilding Credit Intelligence From the Ground Up

Corporate credit has long been dominated by slow-moving incumbents and expensive, closed frameworks. martini.ai is redefining the landscape with:

- Free, daily-updated ratings and research on over 3.5 million public and private companies.

- AI research assistant powered by martini.ai’s proprietary knowledge graph and agentic AI workflows offers dynamic real-time risk assessments.

- Built-in macroeconomic scenario tools for stress testing and ecosystem-wide insights.

- Quantitative and qualitative analysis including benchmarking, narrative references, and backtested signals.

The platform’s methodology mirrors what credit analysts do manually — finding four to five comparable companies for reference — but “puts it on steroids” through a proprietary knowledge graph that connects each company to over 100 others via business relationships, supply chains, news events, and key personnel. This network processes 10,000 to 20,000 reference points daily, including real-time bond prices, loan prices, and bankruptcy filings, to deliver comprehensive risk intelligence.

Cursor for Credit

At the heart of this public launch is martini.ai’s newest innovation, an AI-powered chat assistant purpose-built for finance professionals. Dubbed Cursor for Credit, this tool allows users to instantly research any company, sector, or macro trend by combining real-time credit data, structured financials, and explainable AI. Designed to help analysts, underwriters and investors generate collateral, answer questions, and make faster decisions, it delivers both quantitative metrics and qualitative insights, all orchestrated through martini.ai’s proprietary knowledge graph. With daily updates and transparency baked in, it’s the first agentic AI chat that speaks the language of credit risk.

Unlike generic AI chatbots, martini.ai’s system directly orchestrates its responses through a proprietary knowledge graph that integrates structured credit ratings, real-time market data, sector risk trends, and narrative research, giving users the landscape around a company, not just a snapshot.

“Our platform blends the credit side and the research side,” added Bhat. “You don’t just get the rating — you get the context, the comparables, the sensitivity to macro shifts. And it’s all explainable, backed by sources or data.”

Built for Analysts, Lenders, Researchers

Credit analysts, underwriters, procurement leads, or job seekers can leverage martini.ai’s core credit intelligence tools for free, with optional sign-in to unlock additional features and provide basic user information. For institutions and advanced users, paid tiers unlock deeper functionality, including:

- Custom scenario building and portfolio-level simulation.

- Credit limit automation, vendor monitoring, and trade surveillance.

- Significant risk transfer (SRT) pricing, covenant tracking, and integration into underwriting, ERP or CRM systems.

- API and FTP access for embedding real-time risk data into internal workflows and analytics pipelines.

Transparent, Tested, Trusted

The platform’s accuracy is underpinned by extensive backtesting. Across martini.ai’s full universe of companies, 80% of defaults occurred within the bottom 20% of rated names. In a recent engagement with a bank, martini.ai’s early warning signals flagged bankruptcies an average of seven months before they occurred, highlighting the platform’s real-world predictive power.

Unlike traditional ratings that may update only once every nine months, martini.ai's daily risk assessments could have enabled users to adjust positions in real-time during events like the 2008 financial crisis. This level of transparency and competition in the ratings space naturally drives higher standards and better governance across the market.

“We’re not just providing predictions, we’re providing proof,” said Bhat. “martini.ai is the nimble, next-generation platform built to adapt as the credit world evolves.”

About martini.ai

martini.ai is an AI-native credit analytics platform used by lenders, investors, trade finance teams, and risk managers to assess and monitor the financial health of private and public companies. Powered by a proprietary knowledge graph and agent-based AI tools, the platform provides real-time credit ratings, probability of default curves, and financial risk modeling, enabling smarter decisions across private credit, trade finance, and corporate due diligence. Learn more and try the public tools at www.martini.ai, and follow the company on LinkedIn.

All brands and solution names are trademarks or registered trademarks of their respective companies.

Tags: martini.ai, Rajiv Bhat, credit analysis, credit intelligence, institutional investors, credit investors, risk managers, asset managers, risk assessment, fintech, credit risk, credit ratings, corporate lending, corporate credit, portfolio management, portfolio monitoring, financial services, private credit, private lenders

Contacts

Media Contact

Dottie O’Rourke

TECHMarket Communications, for martini.ai

650-344-1260

martini@techmarket.com