Same Day ACH and Business-to-Business Payments Propel ACH Network Volume Growth in 2025

Same Day ACH and Business-to-Business Payments Propel ACH Network Volume Growth in 2025

RESTON, Va.--(BUSINESS WIRE)--The ACH Network reached new highs in 2025 as both standard and Same Day ACH usage continued to grow, both in the number of payments and their value.

“These impressive results and new records show that the modern ACH Network is continuing to meet the needs of American consumers and businesses for safe, fast payments.”

Share

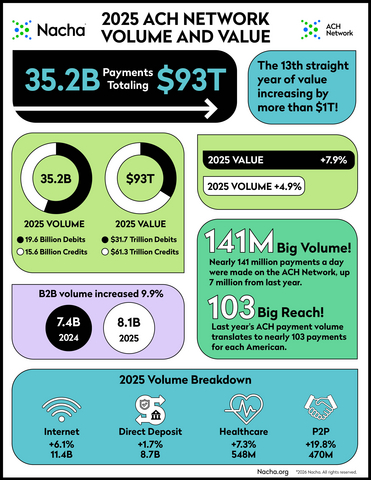

Full year ACH Network volume totaled 35.2 billion payments, up nearly 5% over 2024. The value of those payments reached $93 trillion, an increase of almost 8%. Along the way there were several noteworthy milestones, including:

- December 2025 saw the ACH Network’s highest ever monthly volume of 3.22 billion payments, and the highest monthly volume of Same Day ACH payments of 172.1 million.

- In November 2025, the ACH Network set an average daily volume record of 151 million payments per day.

There were 1.4 billion Same Day ACH payments valued at $3.9 trillion last year, respective increases of 16.7% and 21.4% from 2024. Same Day ACH payments averaged 5.8 million per day in 2025, and 7.8 million per day in December 2025.

“These impressive results and new records show that the modern ACH Network is continuing to meet the needs of American consumers and businesses for safe, fast payments,” said Jane Larimer, Nacha President and CEO.

Business-to-business volume grew almost 10% in 2025, with close to 8.1 billion B2B payments. Healthcare claim payments from insurers to medical and dental providers neared the 548 million mark, up 7.3% from a year earlier.

“Both of those statistics point to businesses large and small turning their backs on checks, a trend that only continues to grow,” said Larimer. “Whether it’s a neighborhood dentist’s office or a multinational corporation, no business should be sending or receiving checks in 2026.”

Also today, Nacha released ACH Network results for the fourth quarter of 2025. There were 9.1 billion ACH payments valued at $24.4 trillion, increases of 5.1% and 8.9% respectively over the last quarter of 2024.

About Nacha

Nacha governs the thriving ACH Network, the payment system that drives safe, smart, and fast Direct Deposits and Direct Payments with the capability to reach all U.S. bank and credit union accounts. There were 35.2 billion ACH Network payments made in 2025, valued at $93 trillion. Through problem-solving and consensus-building among diverse payment industry stakeholders, Nacha advances innovation and interoperability in the payments system. Nacha develops rules and standards, provides industry solutions, and delivers education, accreditation, and advisory services.

Contacts

Dan Roth

Nacha

571-579-0720

media@nacha.org