Customers in Canada Increasingly Turning to Retail Banks for Advice, J.D. Power Finds

Customers in Canada Increasingly Turning to Retail Banks for Advice, J.D. Power Finds

RBC Ranks Highest in Retail Banking Advice Satisfaction

TORONTO--(BUSINESS WIRE)--The financial health of bank customers in Canada—who are pressured by inflation, the rising cost of living and growing personal debt—has been worsening during the past few years. Currently, more than 44% of bank customers are considered financially vulnerable,1 a jump from 36% five years ago. According to the J.D. Power 2025 Canada Retail Banking Advice Satisfaction Study,SM released today, customers are increasingly turning to their banks for advice to help navigate daily financial challenges, with 71% expressing concern about the cost of living and 36% saying they’re struggling to manage housing costs such as mortgage and utilities.

“The eroding financial health of customers and their fear that economic conditions may worsen are driving customers—especially younger ones with growing deposits—to seek financial advice from their retail bank at an accelerated pace,” said Jennifer White, senior director for banking and payments intelligence at J.D. Power. “This combination presents a golden opportunity for retail banks to rise to the challenge and offer services and advice that go beyond the transactional. Customers are shifting their focus from longer-term goals such as investment and retirement planning to more immediate concerns like paying bills, reducing debt and sticking to a budget. Banks that are attuned to their customers’ pain points and can provide relevant and frequent financial advice will be positioned to benefit from a loyal customer base.”

Below are additional key findings of the 2025 study:

- Appetite for bank advice is growing: More than one-fourth (26%) of bank customers say they are “very interested” in receiving bank advice or guidance, up from 19% in 2021. Interest in bank advice is particularly strong among immigrants who have lived in Canada less than two years (47%), as well as among affluent customers (32%) and young mass affluent customers (31%).

- Shift in advice focus: While investment- and retirement-related advice continue to be the most sought-after topics, the study reveals a shift in customer priorities since 2021. Interest in advice addressing immediate needs such as ways to pay bills on time has increased 4 percentage points and borrowing/credit-related guidance has increased 2 percentage points. In contrast, demand for investment- and retirement-focused advice has declined 7 percentage points and 4 percentage points, respectively.

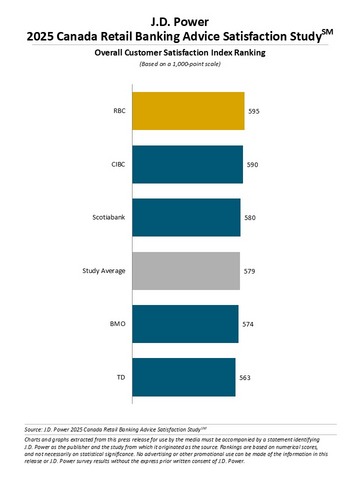

- Rising satisfaction with advice: Banks seem prepared to meet demand as customer satisfaction with the financial advice they are getting from their bank has improved from 2024. Overall satisfaction is 579 (on a 1,000-point scale), 13 points higher than a year ago. Key drivers of this improvement include the frequency, quality and relevancy of the advice, as well as the level of concern financial institutions show for their customers’ needs.

- Advice recall stalls: Although 49% of customers say their bank has done a good job of making their interactions memorable, the trend has plateaued this year. This signals a need to find more effective engagement strategies. The study shows that strong marketing communications that affirm and reassure customers that the bank is there for them when needed (on demand) is the preferred approach.

Study Ranking

RBC ranks highest in customer satisfaction for a fifth consecutive year, with a score of 595. CIBC (590) ranks second and Scotiabank (580) ranks third.

The Canada Retail Banking Advice Satisfaction Study includes responses of retail bank customers in Canada who received any advice/guidance from their primary bank regarding relevant products and services or other financial needs in the past 12 months. It measures customer satisfaction with retail bank advice/guidance based on performance in five core dimensions on a poor-to-perfect rating scale. Individual dimensions measured are (in order of importance): clarity of advice; concern for customer needs; relevancy; quality; and frequency of advice. This year’s study, which includes responses of 2,582 retail bank customers, was fielded from January through March 2025.

In addition to bank financial advice ratings, the study also provides financial health support index benchmarking data that evaluates the proficiency of banks and credit card issuers in delivering financial health support to customers and includes such services as helping customers make better financial decisions or helping them meet savings, creditworthiness or budgeting goals.

Top-performing banks in the banking financial health support index are (in alphabetical order): CIBC and RBC. Top-performing credit card providers in the credit card financial support index are (in alphabetical order): Desjardins, RBC, Scotiabank and TD.

For more information about the Canada Retail Banking Advice Satisfaction Study, visit https://www.jdpower.com/business/financial-health-and-advice-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2025062.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behaviour, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business.

____________________ |

| 1 J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, creditworthiness, and safety net items like insurance coverage. Consumers are placed on a continuum from healthy to vulnerable. |

Contacts

Media Relations Contacts

Gal Wilder, NATIONAL; 416-602-4092; gwilder@national.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info