Omdia Highlights Importance of End User Awareness in Copper Retirement Process

Omdia Highlights Importance of End User Awareness in Copper Retirement Process

LONDON--(BUSINESS WIRE)--Analysis from Omdia’s new report Copper Switch-off Regulations and Policies ‒ 2025 has highlighted that numerous countries have already outlined their copper retirement plans as well as timelines. Where timelines are not explicitly mentioned, regulators still expect incumbents to disclose their copper migration and switch-off plans well in advance, providing customers with sufficient notice.

European countries such as Estonia and Sweden have made significant progress in decommissioning legacy networks. In the Middle East, Qatar and the UAE are examples of countries which have implemented effective migration programs, transitioning more than 85% of their customers to fiber. In Asia, Singapore successfully turned off its copper network as early as 2018. In contrast, Latin America continues to face hurdles. “Copper retirement is progressing slowly in Latin America, with many countries still facing challenges in transitioning to fiber-optic networks due to regulatory and investment barriers”, said Sarah McBride, Principal Analyst, Regulation, at Omdia.

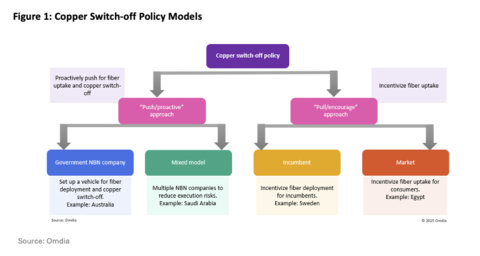

National regulators have adopted various regulatory policy models to govern incumbents switching off their legacy networks that can be broadly classified under two categories: push and pull (Figure 1). Under the push model, countries have been proactively designing policies to replace copper networks, whereas under a pull model, fiber uptake has been incentivized for stakeholders to encourage customer migration so that copper networks can be retired.

“Both approaches have merits in enabling the copper retirement process”, said McBride. Australia and Saudi Arabia for example, followed a push model, establishing national broadband network (NBN) companies to execute fiber deployment and copper switch-off reducing execution risks. Sweden and Egypt on the other hand, followed a pull model by incentivizing fiber deployment for incumbents and uptake by consumers.

Omdia’s report identifies several policy focus areas aimed at supporting and in some cases, accelerating the migration process. These include promoting infrastructure competition, changes to wholesale regulation, and ensuring consumer protection measures are in place, such as raising end user awareness.

“It is this last piece that is most critical”, said McBride. “Regulators are frequently ensuring that telcos protect consumers, especially vulnerable customers, by obligating them to issue formal notifications to wholesale and retail customers outlining timeframes, replacement products, and pricing terms. This increases transparency and empowers customers to make informed decisions, including early contract terminations if they choose not to migrate”, McBride continued.

Regulators such as Ofcom in the UK are already gradually relaxing rules that obligate incumbents to provide wholesale access to their copper network and are instead introducing obligations to offer access to their fiber networks. This includes progressively transferring existing regulation, such as price protection, from copper to fiber services in areas served by ultrafast exchanges.

“This is another key point to emphasize. To enable copper switch-off, it’s essential to transition wholesale obligations from copper to fiber access once sufficient coverage is reached. This is the final step in creating the right conditions for copper networks to be switched off”, said McBride.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Contacts

Fasiha Khan – Fasiha.khan@omdia.com