Trust and Convenience Drive Satisfaction with Credit Unions but Overdraft Fees Present Risks, J.D. Power Finds

Trust and Convenience Drive Satisfaction with Credit Unions but Overdraft Fees Present Risks, J.D. Power Finds

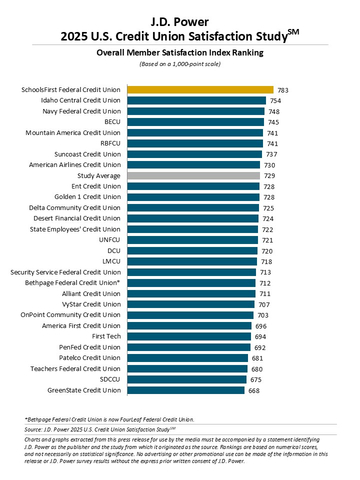

SchoolsFirst Federal Credit Union Ranks Highest among U.S. Credit Unions

TROY, Mich.--(BUSINESS WIRE)--Better interest rates and lower fees offered by credit unions have been a winning combination to earn consistently high satisfaction scores during periods of economic uncertainty. According to the J.D. Power 2025 U.S. Credit Union Satisfaction Study,SM released today, overall satisfaction among credit union members remains unchanged from 2024 at 729 (on a 1,000-point scale). However, satisfaction by age group has changed year over year. Among members under age 40 satisfaction has declined 4 points and is 16 points lower compared with those age 40 and older. For most credit unions, digital interactions and overdraft fees create some challenges, particularly for younger members and those with lower levels of financial health.1

“Credit unions are doing a great job when it comes to their core focus on delivering competitive rates and driving very high levels of member satisfaction, loyalty and brand advocacy,” said Dann Allen, senior director of banking and payments intelligence at J.D. Power. “Top-ranked credit unions perform significantly better than banks in trust-related actions such as supporting members and providing convenience. While digital is a risk for the industry, the study shows that many credit unions are overcoming that challenge.”

Following are some key findings of the 2025 study:

- Credit unions outperform banks in overall satisfaction: This year, overall member satisfaction with U.S. credit unions (729) is 74 points higher than the average overall satisfaction score for U.S. retail banks. Credit unions outperform their retail bank counterparts across all dimensions measured in the study, including trust, people and problem resolution.

- Fees a sore point, especially for younger members: While credit unions have a reputation for offering lower fees than retail banks, nearly one-third (31%) of members under age 40 say they “probably will” or “definitely will” leave their credit union in the next 12 months because of the fees they were charged. That number falls to 25% among members aged 40 and older.

- Financial health affects satisfaction: More than two-thirds (69%) of credit union members are financially unhealthy, which negatively affects overall member satisfaction scores. The average overall satisfaction score among financially healthy credit union members is 788, while the average score among financially unhealthy members is 702.

- Digital in the spotlight: The overall member satisfaction score for credit union digital channels is 715, which is 45 points higher than for retail bank digital channels. However, satisfaction with mobile apps has declined significantly among credit union members who cite lack of clarity of information, range of services and ease of navigation as some of the common problems with their credit union apps.

Study Ranking

SchoolsFirst Federal Credit Union ranks highest in credit union member satisfaction with a score of 783. Idaho Central Credit Union (754) ranks second and Navy Federal Credit Union (748) ranks third.

The U.S. Credit Union Satisfaction Study, now in its second year but first year of being award eligible, measures member satisfaction with the 29 largest credit unions in the continental United States. It measures satisfaction across seven dimensions (in order of importance): trust; people; allowing members to bank how and when they want; account offerings; saving time and money; digital channels; and resolving problems or complaints.

The 2025 study is based on responses from 9,989 credit union members. It was fielded from January 2024 through January 2025. The largest U.S. credit unions are defined as those with at least $7.5 billion in domestic deposits.

For more information about the U.S. Credit Union Satisfaction Study, visit https://www.jdpower.com/business/us-credit-union-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2025033.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, creditworthiness, and safety net items like insurance coverage. Consumers are placed on a continuum from healthy to vulnerable.

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com