Dynacor Group Reports Sales of US$22.8 Million in April 2025

Dynacor Group Reports Sales of US$22.8 Million in April 2025

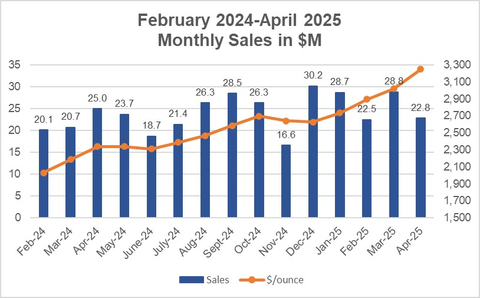

MONTREAL--(BUSINESS WIRE)--Dynacor Group Inc. (TSX-DNG) (“Dynacor” or the "Corporation"), today announced unaudited gold sales of $22.8 million in April and year-to-date sales of $102.8 million. All figures are in US dollars unless otherwise indicated.

Monthly Highlights

- Gold sales reached $22.8 million (C$31.8 million1) in April 2025, compared to $25.0 million (C$34.2 million) in April 2024.

- The decrease in sales of $2.2 million or -8.8% versus April 2024 results from an increase in the sales price (+25.6%) offset by a decrease in the volume (-34.4%). The sale of the last gold pour in April was postponed to early May.

- In April, the selling price of gold averaged $3,248 per ounce, compared to $2,340 per ounce, a 38.8% increase over April 2024.

- The Veta Dorada plant operated at full capacity, processing over 14,000 tonnes of ore as per last year.

Year To Date Highlights

- Cumulative gold sales reached $102.8 million at the end of April 2025, compared to $92.7 million for the same period of 2024, a $10.1 million increase or +10.9%.

- In 2025, the selling price of gold averaged $2,951 per ounce, compared to $2,140 per ounce in 2024, a 37.9% increase.

- The Corporation is on target to meet its annual sales guidance of between $345 and $375 million.

____________________ |

1 Sales are converted using the average monthly exchange rate. |

About Dynacor

Dynacor Group is an industrial ore processing company dedicated to producing gold sourced from artisanal miners. Since its establishment in 1996, Dynacor has pioneered a responsible mineral supply chain with stringent traceability and audit standards for the fast-growing artisanal mining industry. By focusing on fully and part-formalized miners, the Canadian company offers a win-win approach for governments and miners globally. Dynacor operates the Veta Dorada plant and owns a gold exploration property in Peru. The Corporation plans to expand to West Africa and within Latin America.

The premium paid by luxury jewellers for Dynacor’s PX Impact® gold goes to Fidamar Foundation, an NGO that mainly invests in health and education projects for artisanal mining communities in Peru. Visit www.dynacor.com for more information.

Forward-Looking Information

Certain statements in the preceding may constitute forward-looking statements, which involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance, or achievements of Dynacor, or industry results, to be materially different from any future result, performance or achievement expressed or implied by such forward-looking statements. These statements reflect management’s current expectations regarding future events and operating performance as of the date of this news release.

Contacts

For more information, please contact:

Ruth Hanna

Director, Investor Relations

T: 514-393-9000 #236

E: investors@dynacor.com

Website: https://dynacor.com

Renmark Financial Communications Inc.

Bettina Filippone

T: (416) 644-2020 or (212) 812-7680

E: bfilippone@renmarkfinancial.com

Website: www.renmarkfinancial.com